About Credit Scorecards

What Is a Credit Scorecard?

Credit scoring is one of the most widely used credit risk analysis tools. The goal of credit scoring is ranking borrowers by their credit worthiness. In the context of retail credit (credit cards, mortgages, car loans, and so on), credit scoring is performed using a credit scorecard. Credit scorecards represent different characteristics of a customer (age, residential status, time at current address, time at current job, and so on) translated into points and the total number of points becomes the credit score. The credit worthiness of customers is summarized by their credit score; high scores usually correspond to low-risk customers, and conversely. Scores are also used for corporate credit analysis of small and medium enterprises, and, large corporations.

A credit scorecard is a lookup table that maps specific characteristics of a borrower into points. The total number of points becomes the credit score. Credit scorecards are a widely used type of credit scoring model. As such, the goal of a credit scorecard is to distinguish between customers who repay their loans (“good” customers), and customers who will not (“bad” customers). Like other credit scoring models, credit scorecards quantify the risk that a borrower will not repay a loan in the form of a score and a probability of default.

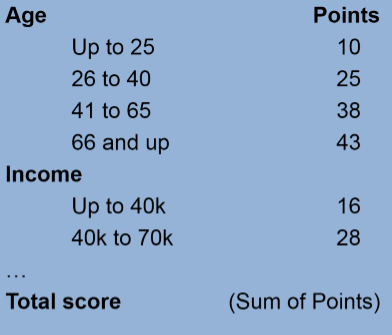

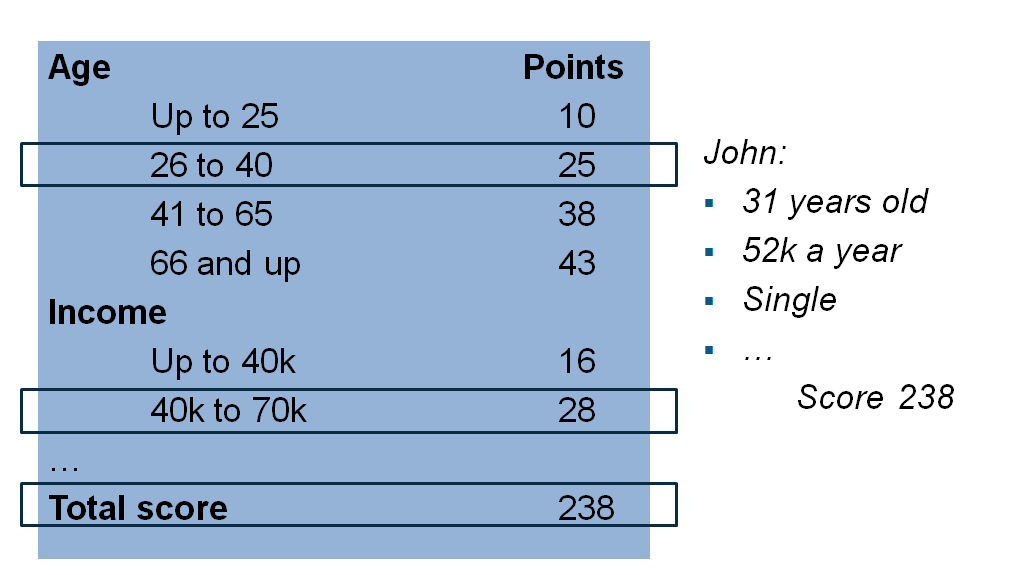

For example, a credit scorecard can give individual borrowers points for their age and income according to the following table. Other characteristics such as residential status, employment status, might also be included, although, for brevity, they are not shown in this table.

Using the credit scorecard in this example, a particular customer who is 31 and has an income of $52,000 a year, is placed into the second age group (26–40) and receives 25 points for their age, and similarly, receives 28 points for their income. Other characteristics (not shown here) might contribute additional points to their score. The total score is the sum of all points, which in this example is assumed to give the customer a total of 238 points (this is a fictitious example on an arbitrary scoring scale).

Technically, to determine the credit scorecard points, start out by selecting a set of potential predictors (column 1 in the next figure). Then, bin data into groups (for example, ages ‘Up to 25’, ’25 to 40’ (column 2 in the figure). This grouping helps to distinguish between “good” and “bad” customers. The Weight of Evidence (WOE) is a way to measure how well the distribution of “good” and “bad” are separated across bins or groups for each individual predictor (column 3 in the figure). By fitting a logistic regression model, you can identify which predictors, when put together, do a better job distinguishing between “good” and “bad” customers. The model is summarized by its coefficients (column 4 in the figure). Finally, the combination of WOE’s and model coefficients (commonly scaled, shifted, and rounded) make up the scorecard points (column 5 in the figure).

Credit Scorecard Development Process

Data gathering and preparation phase

This includes data gathering and integration, such as querying, merging, aligning. It also includes treatment of missing information and outliers. There is a prescreening step based on reports of association measures between the predictors and the response variable. Finally, there is a sampling step, to produce a training set, sometimes called the modeling view, and usually a validation set, too. The training set, in the form of a table, is the required data input to the

creditscorecardobject, and this training set table must be prepared before creating acreditscorecardobject in the Modeling phase.Modeling phase

Use the

creditscorecardobject and associated object functions to develop a credit scorecard model. You can bin the data, apply the Weight of Evidence (WOE) transformation, and compute other statistics, such as the Information Value. You can fit a logistic regression model and also review the resulting scorecard points and format their scaling and rounding. For details on using thecreditscorecardobject, seecreditscorecard.Deployment phase

Deployment entails integrating a credit scorecard model into an IT production environment and keeping tracking logs, performance reports, and so on.

The creditscorecard object is designed for

the Modeling phase of the credit scorecard workflow. Support for all

three phases requires other MathWorks® products.

See Also

creditscorecard | autobinning | bininfo | predictorinfo | modifypredictor | modifybins | bindata | plotbins | fitmodel | displaypoints | formatpoints | score | setmodel | probdefault | validatemodel