Asset Allocation - Hierarchical Risk Parity

From the series: Machine Learning in Finance

You will:

- Learn how to use statistics and machine learning techniques to cluster assets into a hierarchical tree structure.

- Understand how to develop allocation strategies based on the tree structure and risk parity concept through recursion.

- Compare its result with mean-variance asset allocation.

Published: 1 Jan 2020

In this video we will discuss the Hierarchical Risk Parity portfolio construction which produces a much more diversified portfolio compared to the mean-variance method for a similar risk. The HRP focuses on allocation of risk, rather than allocation of capital. The algorithm operates in three stages: tree clustering, quasi-diagonalization, and recursive bisection.

STAGE 1: TREE CLUSTERING

We first use the linkage and dendrogram built-in functions, found in Statistics and Machine Learning Toolbox to construct and visualize the hierarchical tree. The hierarchical clustering is to find the distance between assets and group them into a tree so that allocations can flow downstream through a tree graph.

STAGE 2: QUASI-DIAGONALIZATION

Quasi-diagonalization is then performed, so that the largest values lie along the diagonal. In this way, similar investments are placed together, and dissimilar investments are placed far apart.

STAGE 3: RECURSIVE BISECTION

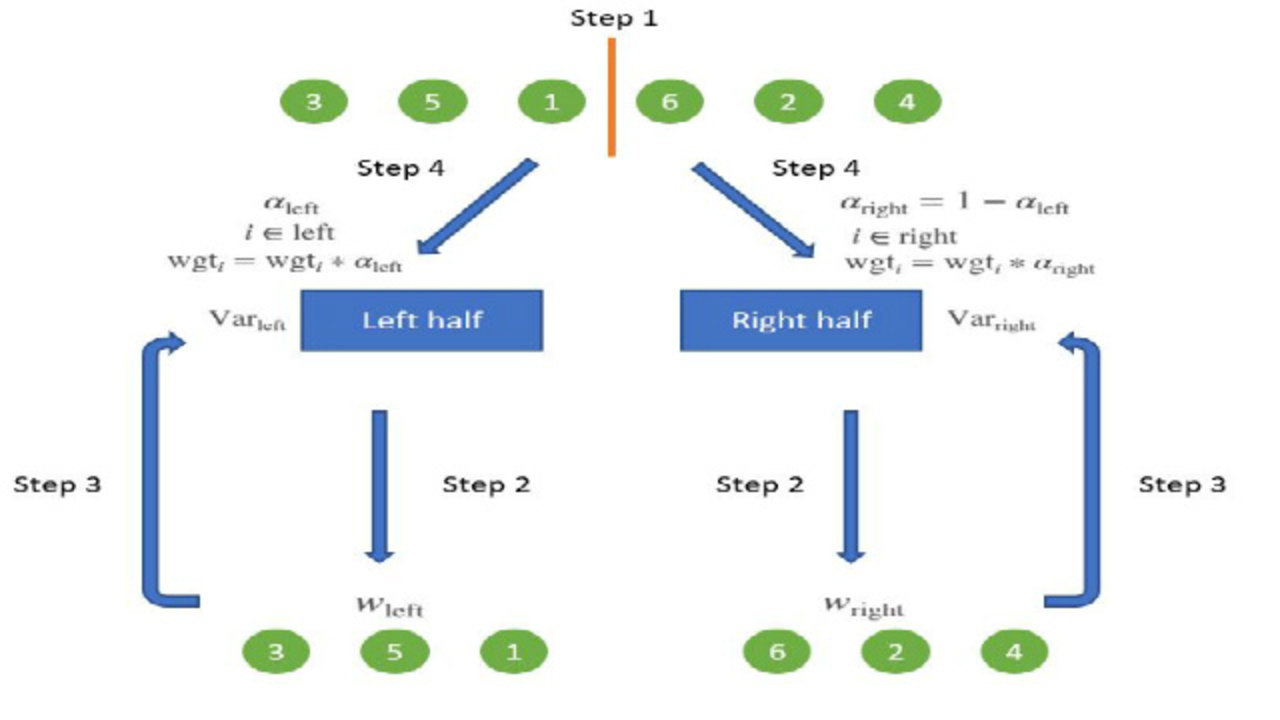

Now, given this tree structure, we are ready to allocate funds using the risk parity concept. Let’s consider the example of four assets. We assign a unit weight to all assets. We bisect the current list into left and right halves. We find the weights of the left and right lists based on inverse variance. We compute the total variance of the left and right halves, as well as the splitting factor alpha. We finally rescale the weights of both halves by alpha. We repeat the exact same algorithm for each half: bisect into left and right sections, calculate the weights and variance, and rescale the weights by alpha. The algorithm stops when we have a single asset per section.

Compare HRP to Mean-Variance Portfolio

We can clearly see that HRP produces a much more diversified allocation compared to mean-variance framework, which concentrates 92% of the allocations on the top six holdings. What drives the mean-variance extreme concentration is its goal of minimizing the portfolio’s risk, and yet both portfolios have a very similar risk. As a result, any distress situation affecting the six top holdings’ allocations will have a greater impact on the mean-variance than the HRP’s portfolio.

Thank you for watching.