fitSmithWilson

Syntax

Description

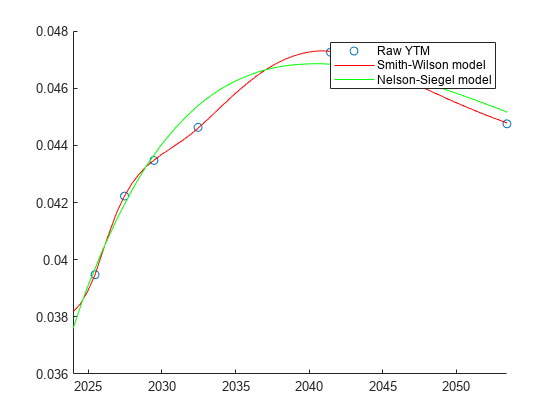

outCurve = fitSmithWilson(Settle,Instruments,CleanPrice,UltimateForwardRate,LastLiquidPoint)parametercurve object.. After

creating a parametercurve object for outCurve, you

can use the associated object functions discountfactors,

zerorates, and

forwardrates.

outCurve = fitSmithWilson(___Name=Value)

Examples

Input Arguments

Name-Value Arguments

Output Arguments

More About

References

[1] Lagerås A., and M. Lindholm. "Issues with Smith-Wilson Method." Insurance: Mathematics and Economics. Vol. 71, 2016, pp. 93–102.

[2] Smith, A., and T. Wilson. "Fitting Yield Curves with Long Term Constraints." Research report, Bacon and Woodrow, 2000.

Version History

Introduced in R2024a