forecast

Forecast responses of univariate regression model with ARIMA time series errors

Syntax

Description

[ returns the

Y,YMSE]

= forecast(Mdl,numperiods)numperiods-by-1 numeric vector of consecutive forecasted responses

Y and the corresponding numeric vector of forecast mean square errors

(MSE) YMSE of the fully specified, univariate regression model with

ARIMA time series errors Mdl.

[ also

forecasts a Y,YMSE,U]

= forecast(Mdl,numperiods)numperiods-by-1 numeric vector of unconditional

disturbances U.

[___] = forecast(___,

specifies options using one or more name-value arguments in

addition to any of the input argument combinations in previous syntaxes.

Name=Value)forecast returns the output argument combination for the

corresponding input arguments. For example, forecast(Mdl,10,Y0=y0,X0=Pred0,XF=Pred)

specifies the presample response path y0, and the presample and

forecast sample predictor data Pred0 and Pred,

respectively, to forecast a model with a regression component.

Tbl = forecast(Mdl,numperiods,Presample=Presample,PresampleRegressionDisturbanceVariable=PresampleRegressionDisturbanceVariable)Tbl containing a variable for each of

the paths of response, forecast MSE, and unconditional disturbance series resulting from

forecasting the regression model with ARIMA errors Mdl over a

numperiods forecast horizon. Presample is a

table or timetable containing presample unconditional disturbance data in the variable

specified by PresampleRegressionDisturbanceVariable. Alternatively,

Presample can contain presample error model innovation data in the

variable specified by PresampleInnovationVariable or a combination of

presample response and predictor data in the variables specified by

PresampleResponseVariable and

PresamplePredictorVariables. You can specify either alternative

instead of PresampleRegressionDisturbanceVariable using name-value

syntax; forecast infers presample unconditional disturbance data

from either alternative specification. (since R2023b)

Tbl = forecast(Mdl,numperiods,InSample=InSample,PredictorVariables=PredictorVariables)PredictorVariables in the in-sample table or

timetable of data InSample containing the predictor data for the

model regression component. (since R2023b)

Tbl = forecast(Mdl,numperiods,Presample=Presample,PresampleRegressionDisturbanceVariable=PresampleRegressionDisturbanceVariable,InSample=InSample,PredictorVariables=PredictorVariables)Presample when it is applicable. (since R2023b)

Tbl = forecast(___,Name=Value)

For example,

forecast(Mdl,20,Presample=PSTbl,PresampleResponseVariables="GDP",PresamplePredictorVariables="CPI",InSample=Tbl,PredictorVariables="CPI")

returns a timetable containing variables for the forecasted responses, forecast MSE, and

forecasted unconditional disturbance paths, forecasted 20 periods into the future.

forecast initializes the model by using the presample response

and predictor data in the GDP and CPI variables of

the timetable PSTbl. forecast applies the

predictor data in the PredictorVariables variables of the table or

timetable Tbl to the model regression component.

Examples

Return a vector of responses, forecasted over a 30-period horizon, from the following regression model with ARMA(2,1) errors:

where is Gaussian with variance 0.1.

Specify the model. Simulate responses from the model and two predictor series.

Mdl0 = regARIMA(Intercept=0,AR={0.5 -0.8},MA=-0.5, ...

Beta=[0.1; -0.2],Variance=0.1);

rng(1,"twister"); % For reproducibility

T = 130;

numperiods = 30;

Pred = randn(T,2);

y = simulate(Mdl0,T,X=Pred);Fit the model to the first 100 observations, and reserve the remaining 30 observations to evaluate forecast performance.

Mdl = regARIMA(2,0,1); estidx = 1:(T-numperiods); % Estimation sample indices fhidx = (T-numperiods+1):T; % Forecast horizon EstMdl = estimate(Mdl,y(estidx),X=Pred(estidx,:));

Regression with ARMA(2,1) Error Model (Gaussian Distribution):

Value StandardError TStatistic PValue

_________ _____________ __________ __________

Intercept 0.0074068 0.012554 0.58999 0.5552

AR{1} 0.55422 0.087265 6.351 2.1391e-10

AR{2} -0.78361 0.080794 -9.6988 3.0499e-22

MA{1} -0.46483 0.1394 -3.3345 0.00085446

Beta(1) 0.092779 0.024497 3.7873 0.00015228

Beta(2) -0.17339 0.021143 -8.2008 2.3874e-16

Variance 0.073721 0.011006 6.6984 2.1066e-11

EstMdl is a new regARIMA model containing the estimates. The estimates are close to their true values.

Use EstMdl to forecast a 30-period horizon.

[yF,yMSE] = forecast(EstMdl,numperiods,Y0=y(estidx), ...

X0=Pred(estidx,:),XF=Pred(fhidx,:));yF is a 30-by-1 vector of forecasted responses and yMSE is a 30-by-1 vector of corresponding forecast MSEs. To initialize the model for forecasting, forecast infers required presample unconditional disturbances from the specified presample response and predictor data.

Visually compare the forecasts to the holdout data using a plot.

figure plot(y,Color=[.7,.7,.7]); hold on plot(fhidx,yF,"b",LineWidth=2); plot(fhidx,yF + 1.96*sqrt(yMSE),"r:",LineWidth=2); plot(fhidx,yF - 1.96*sqrt(yMSE),"r:",LineWidth=2); h = gca; ph = patch([repmat(T-numperiods+1,1,2) repmat(T,1,2)], ... [h.YLim fliplr(h.YLim)],[0 0 0 0],"b"); ph.FaceAlpha = 0.1; legend("Observed","Forecast","95% forecast interval", ... Location="best"); title("30-Period Forecasts and 95% Forecast Intervals") axis tight hold off

Many observations in the holdout sample fall beyond the 95% forecast intervals. Two reasons for this are:

The predictors are randomly generated in this example.

estimatetreats the predictors as fixed. The 95% forecast intervals based on the estimates fromestimatedo not account for the variability in the predictors.By shear chance, the estimation period seems less volatile than the forecast period.

estimateuses the less volatile estimation period data to estimate the parameters. Therefore, forecast intervals based on the estimates should not cover observations that have an underlying innovations process with larger variability.

Forecast stationary, log GDP using a regression model with ARMA(1,1) errors, including CPI as a predictor.

Fit a regression model with ARMA(1,1) errors by regressing the US gross domestic product (GDP) growth rate onto consumer price index (CPI) quarterly changes. Forecast the model into a 2-year (8-quarter) horizon. Supply a timetable of data and specify the series for the fit.

Load and Transform Data

Load the US macroeconomic data set. Compute the series of GDP quarterly growth rates and CPI quarterly changes.

load Data_USEconModel DTT = price2ret(DataTimeTable,DataVariables="GDP"); DTT.GDPRate = 100*DTT.GDP; DTT.CPIDel = diff(DataTimeTable.CPIAUCSL); T = height(DTT)

T = 248

figure tiledlayout(2,1) nexttile plot(DTT.Time,DTT.GDPRate) title("GDP Rate") ylabel("Percent Growth") nexttile plot(DTT.Time,DTT.CPIDel) title("Index")

The series appear stationary, albeit heteroscedastic.

Prepare Timetable for Estimation

When you plan to supply a timetable, you must ensure it has all the following characteristics:

The selected response variable is numeric and does not contain any missing values.

The timestamps in the

Timevariable are regular, and they are ascending or descending.

Remove all missing values from the timetable.

DTT = rmmissing(DTT); T_DTT = height(DTT)

T_DTT = 248

Because each sample time has an observation for all variables, rmmissing does not remove any observations.

Determine whether the sampling timestamps have a regular frequency and are sorted.

areTimestampsRegular = isregular(DTT,"quarters")areTimestampsRegular = logical

0

areTimestampsSorted = issorted(DTT.Time)

areTimestampsSorted = logical

1

areTimestampsRegular = 0 indicates that the timestamps of DTT are irregular. areTimestampsSorted = 1 indicates that the timestamps are sorted. Macroeconomic series in this example are timestamped at the end of the month. This quality induces an irregularly measured series.

Remedy the time irregularity by shifting all dates to the first day of the quarter.

dt = DTT.Time; dt = dateshift(dt,"start","quarter"); DTT.Time = dt; areTimestampsRegular = isregular(DTT,"quarters")

areTimestampsRegular = logical

1

DTT is regular.

Create Model Template for Estimation

Suppose that a regression model of CPI quarterly changes onto the GDP rate, with ARMA(1,1) errors, is appropriate.

Create a model template for a regression model with ARMA(1,1) errors template. Specify the response variable name.

Mdl = regARIMA(1,0,1);

Mdl.SeriesName = "GDPRate";Mdl is a partially specified regARIMA object.

Partiton Data

Partition the data set into estimation and forecast samples.

fh = 8; DTTES = DTT(1:(T_DTT-fh),:); DTTFS = DTT((T_DTT-fh+1):end,:);

Fit Model to Data

Fit a regression model with ARMA(1,1) errors to the estimation sample. Specify the entire series GDP rate and CPI quarterly changes series, and specify the predictor variable name.

EstMdl = estimate(Mdl,DTTES,PredictorVariables="CPIDel");

Regression with ARMA(1,1) Error Model (Gaussian Distribution):

Value StandardError TStatistic PValue

__________ _____________ __________ __________

Intercept 0.016489 0.0017307 9.5272 1.6152e-21

AR{1} 0.57835 0.096952 5.9653 2.4415e-09

MA{1} -0.15125 0.11658 -1.2974 0.19449

Beta(1) 0.0025095 0.0014147 1.7738 0.076089

Variance 0.00011319 7.5405e-06 15.01 6.2792e-51

EstMdl is a fully specified, estimated regARIMA object. By default, estimate backcasts for the required Mdl.P = 1 presample regression model residual and sets the required Mdl.Q = 1 presample error model residual to 0.

Forecast Estimated Model

Forecast the GDP rate over a 8-quarter horizon. Use the estimation sample as a presample for the forecast.

Tbl = forecast(EstMdl,fh,Presample=DTTES,PresampleResponseVariable="GDPRate", ... PresamplePredictorVariables="CPIDel",InSample=DTTFS, ... PredictorVariables="CPIDel")

Tbl=8×7 timetable

Time Interval GDP GDPRate CPIDel GDPRate_Response GDPRate_MSE GDPRate_RegressionInnovation

_____ ________ ___________ __________ ______ ________________ ___________ ____________________________

Q2-07 91 0.00018278 0.018278 1.675 0.015765 0.00011319 -0.0049278

Q3-07 91 0.00016916 0.016916 1.359 0.01705 0.00013383 -0.00285

Q4-07 94 6.1286e-05 0.0061286 3.355 0.02326 0.00014074 -0.0016483

Q1-08 91 9.3272e-05 0.0093272 1.93 0.020379 0.00014305 -0.00095329

Q2-08 91 0.00011103 0.011103 3.367 0.024387 0.00014382 -0.00055134

Q3-08 92 8.9585e-05 0.0089585 1.641 0.020288 0.00014408 -0.00031887

Q4-08 92 -0.00016145 -0.016145 -7.098 -0.0015075 0.00014417 -0.00018442

Q1-09 90 -8.6878e-05 -0.0086878 1.137 0.019236 0.0001442 -0.00010666

Tbl is a 8-by-7 timetable containing the forecasted responses GDPRate_Response and their forecast MSEs GDPRate_MSE, the forecasted unconditional disturbances GDPRate_RegressionInnovation, and all variables in DTTFS.

Plot the forecasts and 95% forecast intervals.

Tbl.Lower = Tbl.GDPRate_Response - 1.96*sqrt(Tbl.GDPRate_MSE); Tbl.Upper = Tbl.GDPRate_Response + 1.96*sqrt(Tbl.GDPRate_MSE); figure h1 = plot(DTT.Time(end-65:end),DTT.GDPRate(end-65:end), ... Color=[.7,.7,.7]); hold on h2 = plot(Tbl.Time,Tbl.GDPRate_Response,"b",LineWidth=2); h3 = plot(Tbl.Time,Tbl.Lower,"r:",LineWidth=2); plot(DTTFS.Time,Tbl.Upper,"r:",LineWidth=2); ha = gca; title("GDP Rate Forecasts and 95% Forecast Intervals") ph = patch([repmat(Tbl.Time(1),1,2) repmat(Tbl.Time(end),1,2)],... [ha.YLim fliplr(ha.YLim)],... [0 0 0 0],"b"); ph.FaceAlpha = 0.1; legend([h1 h2 h3],["Observed GDP rate" "Forecasted GDP rate", ... "95% forecast interval"],Location="best") axis tight hold off

Fit a regression model with ARIMA(1,1,1) errors by regressing the quarterly log US GDP onto the log CPI. Compute MMSE forecasts of the log GDP series using the estimated model. Supply data in timetables.

Load the US macroeconomic data set. Compute the log GDP series.

load Data_USEconModel

DTT = DataTimeTable;

DTT.LogGDP = log(DTT.GDP);

T = height(DTT);Remedy the time irregularity by shifting all dates to the first day of the quarter.

dt = DTT.Time; dt = dateshift(dt,"start","quarter"); DTT.Time = dt;

Reserve 2 years (8 quarters) of data at the end of the series to compare against the forecasts.

numperiods = 8; DTTES = DTT(1:(T-numperiods),:); % Estimation sample DTTFS = DTT((T-numperiods+1):T,:); % Forecast horizon

Suppose that a regression model of the quarterly log GDP on CPI, with ARMA(1,1) errors, is appropriate.

Create a model template for a regression model with ARMA(1,1) errors template. Specify the response variable name.

Mdl = regARIMA(1,1,1);

Mdl.SeriesName = "LogGDP";The intercept is not identifiable in a regression model with integrated errors. Fix its value before estimation. One way to do this is to estimate the intercept using simple linear regression. Use the estimation sample.

coeff = [ones(T-numperiods,1) DTTES.CPIAUCSL]\DTTES.LogGDP; Mdl.Intercept = coeff(1);

Consider performing a sensitivity analysis by using a grid of intercepts.

Reserve 2 years (8 quarters) of data at the end of the series to compare against the forecasts.

numperiods = 8; estidx = 1:(T-numperiods); % Estimation sample frstHzn = (T-numperiods+1):T; % Forecast horizon

Fit a regression model with ARMA(1,1,1) errors to the estimation sample. Specify the predictor variable name.

EstMdl = estimate(Mdl,DTTES,PredictorVariables="CPIAUCSL");

Regression with ARIMA(1,1,1) Error Model (Gaussian Distribution):

Value StandardError TStatistic PValue

__________ _____________ __________ ___________

Intercept 5.8303 0 Inf 0

AR{1} 0.92869 0.028414 32.684 2.6126e-234

MA{1} -0.39063 0.057599 -6.7819 1.1858e-11

Beta(1) 0.0029335 0.0014645 2.0031 0.045166

Variance 0.00010668 6.9256e-06 15.403 1.554e-53

EstMdl is a fully specified, estimated regARIMA object. By default, estimate backcasts for the required Mdl.P = 2 presample regression model residual and sets the required Mdl.Q = 1 presample error model residual to 0.

Infer estimation sample unconditional disturbances to initialize the model for forecasting. Specify the predictor variable name.

Tbl0 = infer(EstMdl,DTTES,PredictorVariables="CPIAUCSL");Forecast the estimated model over an 8-quarter horizon. Use the inferred unconditional disturbances as presample data. Specify the forecast sample predictor data and its variable name, and specify the presample unconditional disturbance variable name.

Tbl = forecast(EstMdl,numperiods,Presample=Tbl0, ... PresampleRegressionDisturbanceVariable="LogGDP_RegressionResidual", ... InSample=DTTFS,PredictorVariables="CPIAUCSL");

Plot the forecasted log GDP with approximate 95% forecast intervals. Also, separately plot the unconditional disturbances.

Tbl.Lower = Tbl.LogGDP_Response - 1.96*sqrt(Tbl.LogGDP_MSE); Tbl.Upper = Tbl.LogGDP_Response + 1.96*sqrt(Tbl.LogGDP_MSE); figure tiledlayout(2,1) nexttile plot(DTT.Time(end-40:end),DTT.LogGDP(end-40:end),Color=[.7,.7,.7]) hold on h1 = plot(Tbl.Time,[Tbl.Lower Tbl.Upper],"r:",LineWidth=2); h2 = plot(Tbl.Time,Tbl.LogGDP_Response,"k",LineWidth=2); h = gca; ph = patch([repmat(Tbl.Time(1),1,2) repmat(Tbl.Time(end),1,2)], ... [h.YLim fliplr(h.YLim)],[0 0 0 0],"b"); ph.FaceAlpha = 0.1; legend([h1(1) h2],["95% percentile intervals" "MMSE forecast"], ... Location="northwest") axis tight grid on title("Log GDP Forecast Over 2-year Horizon") hold off nexttile plot(DTT.Time,[Tbl0.LogGDP_RegressionResidual; Tbl.LogGDP_RegressionInnovation]) hold on h = gca; ph = patch([repmat(Tbl.Time(1),1,2) repmat(Tbl.Time(end),1,2)], ... [h.YLim fliplr(h.YLim)],[0 0 0 0],"b"); ph.FaceAlpha = 0.1; axis tight grid on title("Unconditional Disturbances") hold off

The unconditional disturbances, , are nonstationary, therefore the widths of the forecast intervals grow with time.

Input Arguments

Forecast horizon, or the number of time points in the forecast period, specified as a positive integer.

Data Types: double

Since R2023b

Presample data containing presample responses

yt, predictors

xt, unconditional disturbances

ut, or error model innovations

εt, to initialize the model, specified as

a table or timetable with numprevars variables and

numpreobs rows. You can select a response, error model innovation,

unconditional disturbance, or multiple predictor variables from

Presample by using the

PresampleResponseVariable,

PresampleErrorInnovationVariable,

PresampleRegressionDisturbanceVariable, or

PresamplePredictorVariables name-value argument,

respectively.

numpreobs is the number of presample observations.

numpaths is the maximum number of independent presample paths among

the specified variables, from which forecast initializes the

resulting numpaths forecasts (see Algorithms).

For all selected variables except predictor variables, each variable contains a

single path (numpreobs-by-1 vector) or multiple paths

(numpreobs-by-numpaths matrix) of presample

response, error model innovation, or unconditional disturbance data.

Each selected predictor variable contains a single path of observations.

forecast applies all selected predictor variables to each

forecasted path.

Each row is a presample observation, and measurements in each row occur

simultaneously. The last row contains the latest presample observation.

forecast uses only the latest required rows. For more details,

see Time Base Partitions for Forecasting.

Presample unconditional disturbances ut are required to initialize the error model for forecasting. You can specify presample unconditional disturbances in one of the following ways:

Specify

numpreobs≥Mdl.Ppresample response and predictor data to enableforecastto infer presample unconditional disturbances.Specify

numpreobs≥Mdl.Ppresample unconditional disturbances without presample error model innovations.forecastignores specified presample response and predictor data.Specify

numpreobs≥Mdl.Qpresample error model innovations without presample unconditional disturbances.forecastignores specified presample response and predictor data.Specify

numpreobs≥max(Mdl.P,Mdl.Q)presample error model innovations and unconditional disturbances only.forecastignores specified presample response and predictor data.

If Presample is a timetable, all the following conditions must

be true:

Presamplemust represent a sample with a regular datetime time step (seeisregular).The datetime vector of sample timestamps

Presample.Timemust be ascending or descending.

If Presample is a table, the last row contains the latest

presample observation.

By default, forecast sets all necessary presample

unconditional disturbances in one of the following ways:

If

forecastcannot infer enough unconditional disturbances from specified presample response and predictor data,forecastsets all necessary presample unconditional disturbances to zero.If you specify at least

Mdl.P + Mdl.Qpresample unconditional disturbances,forecastinfers all necessary presample error model innovations from the specified presample unconditional disturbances. Otherwise,forecastsets all necessary presample error model innovations to zero.

Since R2023b

Presample unconditional disturbance variable

ut to select from

Presample containing presample unconditional disturbance data,

specified as one of the following data types:

String scalar or character vector containing a variable name in

Presample.Properties.VariableNamesVariable index (positive integer) to select from

Presample.Properties.VariableNamesA logical vector, where

PresampleRegressionDisturbanceVariable(selects variablej) = truejPresample.Properties.VariableNames

The selected variable must be a numeric vector and cannot contain missing values

(NaNs).

If you specify presample unconditional disturbance data in

Presample, you must specify

PresampleRegressionDisturbanceVariable.

Example: PresampleRegressionDisturbanceVariable="StockRateU0"

Example: PresampleRegressionDisturbanceVariable=[false false true

false] or PresampleRegressionDisturbanceVariable=3

selects the third table variable as the presample unconditional disturbance

variable.

Data Types: double | logical | char | cell | string

Since R2023b

Forecasted (future) predictor data for the model regression component, specified as

a table or timetable. InSample contains numvars

variables, including numpreds predictor variables

xt.

forecast returns the forecasted variables in the output

table or timetable Tbl, which is commensurate with

InSample.

Each row corresponds to an observation in the forecast horizon, the first row is the

earliest observation, and measurements in each row, among all paths, occur

simultaneously. InSample must have at least

numperiods rows to cover the forecast horizon. If you supply more

rows than necessary, forecast uses only the first

numperiods rows.

Each selected predictor variable is a numeric vector without missing values

(NaNs). forecast applies the specified

predictor variables to all forecasted paths.

If InSample is a timetable, the following conditions apply:

If InSample is a table, the last row contains the latest

observation.

By default, forecast does not include the regression

component in the model, regardless of the value of Mdl.Beta.

Since R2023b

Predictor variables xt to select from

InSample containing predictor data for the model regression

component in the forecast horizon, specified as one of the following data types:

String vector or cell vector of character vectors containing

numpredsvariable names inInSample.Properties.VariableNamesA vector of unique indices (positive integers) of variables to select from

InSample.Properties.VariableNamesA logical vector, where

PredictorVariables(selects variablej) = truejInSample.Properties.VariableNames

The selected variables must be numeric vectors and cannot contain missing values

(NaNs).

By default, forecast excludes the regression component,

regardless of its presence in Mdl.

Example: PredictorVariables=["M1SL" "TB3MS"

"UNRATE"]

Example: PredictorVariables=[true false true false] or

PredictorVariable=[1 3] selects the first and third table variables

to supply the predictor data.

Data Types: double | logical | char | cell | string

Name-Value Arguments

Specify optional pairs of arguments as

Name1=Value1,...,NameN=ValueN, where Name is

the argument name and Value is the corresponding value.

Name-value arguments must appear after other arguments, but the order of the

pairs does not matter.

Before R2021a, use commas to separate each name and value, and enclose

Name in quotes.

Example: For example, forecast(Mdl,10,Y0=y0,X0=Pred0,XF=Pred)

specifies the presample response path y0, and the presample and forecast

sample predictor data Pred0 and Pred, respectively,

to forecast a model with a regression component.

Presample response data yt to infer

presample unconditional disturbances ut,

specified as a numpreobs-by-1 numeric column vector or a

numpreobs-by-numpaths numeric matrix. When you

supply Y0, supply all optional data as numeric arrays, and

forecast returns results in numeric arrays.

Presample unconditional disturbances ut

are required to initialize the error model for forecasting.

forecast infers presample unconditional disturbances from

Y0 and specified presample predictor data

X0. Therefore, if you specify presample unconditional

disturbances U0, forecast ignores

Y0 and X0.

numpreobs is the number of presample observations.

numpaths is the number of independent presample paths, from which

forecast initializes the resulting

numpaths forecasts (see Algorithms).

Each row is a presample observation, and measurements in each row occur

simultaneously. The last row contains the latest presample observation.

numpreobs must be at least Mdl.P to initialize

the model. If numpreobs > Mdl.P,

forecast uses only the latest Mdl.P rows.

For more details, see Time Base Partitions for Forecasting.

Columns of Y0 correspond to separate, independent presample

paths.

If

Y0is a column vector, it represents a single path of the response series.forecastapplies it to each forecasted path. In this case, all forecast pathsYderive from the same initial responses.If

Y0is a matrix, each column represents a presample path of the response series.numpathsis the maximum among the second dimensions of the specified presample observation matricesY0,E0, andU0.

By default, forecast defers to specified or default

presample unconditional disturbances U0.

Data Types: double

Presample predictor data xt used to

infer the presample unconditional disturbances

ut, specified as a

numpreobs-by-numpreds numeric matrix. Use

X0 only when you supply the numeric array of presample response

data Y0 and your model contains a regression component.

numpreds = numel(Mdl.Beta).

Presample unconditional disturbances ut

are required to initialize the error model for forecasting.

forecast infers presample unconditional disturbances from

X0 and specified presample response data

Y0. Therefore, if you specify presample unconditional

disturbances U0, forecast ignores

Y0 and X0.

Each row is a presample observation, and measurements in each row occur

simultaneously. The last row contains the latest presample observation.

numpreobs must be at least Mdl.P to initialize

the model. If numpreobs > Mdl.P,

forecast uses only the latest Mdl.P rows.

For more details, see Time Base Partitions for Forecasting.

Each column is an individual predictor variable. forecast

applies X to each path; that is, X represents

one path of observed predictors.

If you specify X0 but you do not specify forecasted predictor

data XF, forecast issues an error.

By default, forecast drops the regression component from

the model when it infers presample unconditional disturbances, regardless of the value

of the regression coefficient Mdl.Beta.

Data Types: double

Presample unconditional disturbance data

ut to initialize the autoregressive (AR)

component of the ARIMA error model, specified as a numpreobs-by-1

numeric column vector or a numpreobs-by-numpaths

numeric matrix. When you supply U0, supply all optional data as

numeric arrays, and forecast returns results in numeric

arrays.

Each row is a presample observation, and measurements in each row occur

simultaneously. The last row contains the latest presample observation.

numpreobs must be at least Mdl.P to initialize

the model. If numpreobs > Mdl.P,

forecast uses only the latest Mdl.P rows.

For more details, see Time Base Partitions for Forecasting.

Columns of U0 correspond to separate, independent presample

paths.

If

U0is a column vector, it represents a single path of the unconditional disturbance series.forecastapplies it to each forecasted path. In this case, all forecasted paths derive from the same initial responses.If

U0is a matrix, each column represents a presample path of the unconditional disturbance series.numpathsis the maximum among the second dimensions of the specified presample observation matricesY0,E0, andU0.

By default, if the presample data (Y0 and

X0) contains at least Mdl.P rows,

forecast infers U0 from the presample

data. If you do not specify presample data, then all required presample unconditional

disturbances are zero.

Data Types: double

Presample error model innovation data εt

used to initialize either the moving average (MA) component of the ARIMA error model,

specified as a numpreobs-by-1 column vector or

numpreobs-by-numpaths numeric matrix. Use

E0 only when you supply the numeric array of presample response

data Y0. forecast assumes that the

presample innovations have a mean of zero.

Each row is a presample observation, and measurements in each row occur

simultaneously. The last row contains the latest presample observation.

numpreobs must be at least Mdl.Q to initialize

the model. If numpreobs is greater than required,

forecast uses only the latest required rows.

Columns of E0 correspond to separate, independent presample

paths.

If

E0is a column vector, it represents a single path of the innovation series.forecastapplies it to each forecasted path. In this case, all forecasts derive from the same initial error model innovations.If

E0is a matrix, each column represents a presample path of the error model innovation series.numpathsis the maximum among the second dimensions of the specified presample observation matricesY0,U0, andU0.

By default, if U0 contains at least Mdl.P

+ Mdl.Q rows, forecast infers

E0 from U0. If U0 has an

insufficient number of rows and forecast cannot infer

sufficient observations of U0 from the presample data

(Y0 and X0), forecast

sets necessary presample error model innovations to zero.

Data Types: double

Since R2023b

Response variable yt to select from

Presample containing the presample response data, specified as

one of the following data types:

String scalar or character vector containing a variable name in

Presample.Properties.VariableNamesVariable index (positive integer) to select from

Presample.Properties.VariableNamesA logical vector, where

PreampleResponseVariable(selects variablej) = truejPresample.Properties.VariableNames

forecast uses specified presample response and predictor

data to infer presample unconditional disturbances. If you specify enough presample

unconditional disturbances or error model innovations by using

Presample and

PresampleRegressionDisturbanceVariable or

PresampleInnovationVariable, forecast

ignores PresamplePredictorVariables and

PresampleResponseVariable.

The selected variable must be a numeric vector and cannot contain missing values

(NaNs).

If you specify presample response data by using the Presample

name-value argument, you must specify

PresampleResponseVariable.

Example: PresampleResponseVariable="StockRate"

Example: PresampleResponseVariable=[false false true false] or

PresampleResponseVariable=3 selects the third table variable as

the response variable.

Data Types: double | logical | char | cell | string

Since R2023b

Presample predictor variables xt to

select from Presample containing presample predictor data for the

regression component in the presample period, specified as one of the following data types:

String vector or cell vector of character vectors containing

numpredsvariable names inPresample.Properties.VariableNamesA vector of unique indices (positive integers) of variables to select from

Presample.Properties.VariableNamesA logical vector, where

PresamplePredictorVariables(selects variablej) = truejPresample.Properties.VariableNames

forecast uses specified presample response and predictor

data to infer presample unconditional disturbances. If you specify enough presample

unconditional disturbances or error model innovations by using

Presample and

PresampleRegressionDisturbanceVariable or

PresampleInnovationVariable, forecast

ignores PresamplePredictorVariables and

PresampleResponseVariable.

The selected variables must be numeric vectors and cannot contain missing values

(NaNs).

If you specify presample predictor data, you must also specify in-sample predictor

data by using the InSample and

PredictorVariables name-value arguments.

By default, forecast excludes the regression component,

regardless of its presence in Mdl.

Example: PresamplePredictorVariables=["M1SL" "TB3MS"

"UNRATE"]

Example: PresamplePredictorVariables=[true false true false] or

PredictorVariable=[1 3] selects the first and third table

variables to supply the predictor data.

Data Types: double | logical | char | cell | string

Since R2023b

Presample error model innovation variable of

εt to select from

Presample containing presample error model innovation data,

specified as one of the following data types:

String scalar or character vector containing a variable name in

Presample.Properties.VariableNamesVariable index (positive integer) to select from

Presample.Properties.VariableNamesA logical vector, where

PresampleInnovationVariable(selects variablej) = truejPresample.Properties.VariableNames

The selected variable must be a numeric matrix and cannot contain missing values

(NaNs).

If you specify presample error model innovation data in

Presample, you must specify

PresampleInnovationVariable.

Example: PresampleInnovationVariable="StockRateDist0"

Example: PresampleInnovationVariable=[false false true false] or

PresampleInnovationVariable=3 selects the third table variable as

the presample error model innovation variable.

Data Types: double | logical | char | cell | string

Forecasted (or future) predictor data, specified as a numeric matrix with

numpreds columns. XF represents the evolution

of specified presample predictor data X0 forecasted into the

future (the forecast period). Use XF only when you supply the

numeric array of presample response and predictor data Y0 and

X0, respectively.

Rows of XF correspond to time points in the future;

XF( contains the

t,:)t-period-ahead predictor forecasts. XF

must have at least numperiods rows. If the number of rows exceeds

numperiods, forecast uses only the first

(earliest) numperiods forecasts. For more details, see Time Base Partitions for Forecasting.

Columns of XF are separate time series variables, and they

correspond to the columns of X0 and

Mdl.Beta.

forecast treats XF as a fixed

(nonstochastic) matrix.

By default, the forecast function generates forecasts from

Mdl without a regression component, regardless of the value of

the regression coefficient Mdl.Beta.

Note

NaNvalues inX0,Y0,U0,E0, andXFindicate missing values.forecastremoves missing values from specified data by list-wise deletion.For the presample,

forecasthorizontally concatenates the possibly jagged arraysX0,Y0,U0, andE0with respect to the last rows, and then it removes any row of the concatenated matrix containing at least oneNaN.For in-sample data,

forecastremoves any row ofXFcontaining at least oneNaN.

This type of data reduction reduces the effective sample size and can create an irregular time series.

For numeric data inputs,

forecastassumes that you synchronize the presample data such that the latest observations occur simultaneously.forecastissues an error when any table or timetable input contains missing values.Set presample response and predictor data to the same response and predictor data as used in the estimation, simulation, or inference of

Mdl. This assignment ensures correct inference of the required presample unconditional disturbances.To include a regression component in the response forecast, you must specify the forecasted predictor data. You can specify forecasted predictor data without also specifying presample predictor data, but

forecastissues an error when you specify presample predictor data without also specifying forecasted predictor data.

Output Arguments

MMSE forecasted responses yt, returned as

a numperiods-by-1 column vector or a

numperiods-by-numpaths numeric matrix.

Y represents a continuation of Y0

(Y(1,:) occurs in the time point immediately after

Y0(end,:)). forecast returns

Y by default and when you supply optional data presample data in

numeric arrays.

Y( contains the

t,:)t-period-ahead forecasts, or the

forecast of all paths for time point t in the forecast

period.

forecast determines numpaths from the

number of columns in the presample data sets Y0,

E0, and U0. For details, see Algorithms. If each presample data set

has one column, Y is a column vector.

Data Types: double

MSE of the forecasted responses Y (forecast error variances),

returned as a numperiods-by-1 column vector or a

numperiods-by-numpaths numeric matrix.

forecast returns YMSE by default and when

you supply optional data presample data in numeric arrays.

YMSE( contains the forecast error

variances of all paths for time point t,:)t in the forecast

period.

forecast determines numpaths from the

number of columns in the presample data sets Y0,

E0, and U0. For details, see Algorithms. If you do not specify any

presample data sets, or if each data set is a column vector, YMSE is

a column vector.

The square roots of YMSE are the standard errors of the forecasts

Y.

Data Types: double

MMSE forecasts of ARIMA error model unconditional disturbances, returned as a

numperiods-by-1 column vector or a

numperiods-by-numpaths numeric matrix.

U represents a continuation of U0

(U(1,:) occurs in the time point immediately after

U0(end,:)). forecast returns

U by default and when you supply optional data presample data in

numeric arrays.

U( contains the

t,:)t-period-ahead forecasted unconditional

disturbances, or the conditional mean forecast of the error model over all

paths for time point t in the forecast period.

forecast determines numpaths from the

number of columns in the presample data sets Y0,

E0, and U0. For details, see Algorithms.

Data Types: double

Since R2023b

Paths of MMSE forecasts of responses yt,

corresponding forecast MSEs, and MMSE forecasts of unconditional disturbances

ut, returned as a table or timetable, the

same data type as Presample or InSample.

forecast returns Tbl only when you supply

Presample or InSample.

Tbl contains the following variables:

The forecasted response paths, which are in a

numperiods-by-numpathsnumeric matrix, with rows representing periods in the forecast horizon and columns representing independent paths, each corresponding to the input presample paths inPresampleor preceding the in-sample period inInSample.forecastnames the forecasted response variableresponseName_ResponseresponseNameMdl.SeriesName. For example, ifMdl.SeriesNameisGDP,Tblcontains a variable for the corresponding forecasted response paths with the nameGDP_Response.Each path in

Tbl.represents the continuation of the corresponding presample response path inresponseName_ResponsePresample(Tbl.occurs in the next time point, with respect to the periodicityresponseName_Response(1,:)Presample, after the last presample response).Tbl.contains theresponseName_Response(j,k)j-period-ahead forecasted response of pathk.The forecast MSE paths, which are in a

numperiods-by-numpathsnumeric matrix, with rows representing periods in the forecast horizon and columns representing independent paths, each corresponding to the forecasted responses inTbl..responseName_Responseforecastnames the forecast MSEsresponseName_MSEresponseNameMdl.SeriesName. For example, ifMdl.SeriesNameisGDP,Tblcontains a variable for the corresponding forecast MSE with the nameGDP_MSE.The forecasted unconditional disturbance paths, which are in a

numperiods-by-numpathsnumeric matrix, with rows representing periods in the forecast horizon and columns representing independent paths.forecastnames the forecasted unconditional disturbance variableresponseName_RegressionInnovationresponseNameMdl.SeriesName. For example, ifMdl.SeriesNameisGDP,Tblcontains a variable for the corresponding forecasted unconditional disturbance paths with the nameGDP_RegressionInnovation.Each path in

Tbl.represents a continuation of the presample unconditional disturbance process, either supplied by or inferred fromresponseName_RegressionInnovationPresample, or set by default (Tbl.occurs in the next time point, with respect to the periodicityresponseName_RegressionInnovation(1,:)Presample, after the last presample unconditional disturbance).Tbl.contains theresponseName_RegressionInnovation(j,k)j-period-ahead forecasted unconditional disturbance of pathk.When you supply

InSample,Tblcontains all variables inInSample.

If Presample is a timetable, the following conditions hold:

The row order of

Tbl, either ascending or descending, matches the row order ofPresample.Tbl.Time(1)is the next time afterPresample.Time(end)relative the sampling frequency, andTbl.Time(2:numobs)are the following times relative to the sampling frequency.

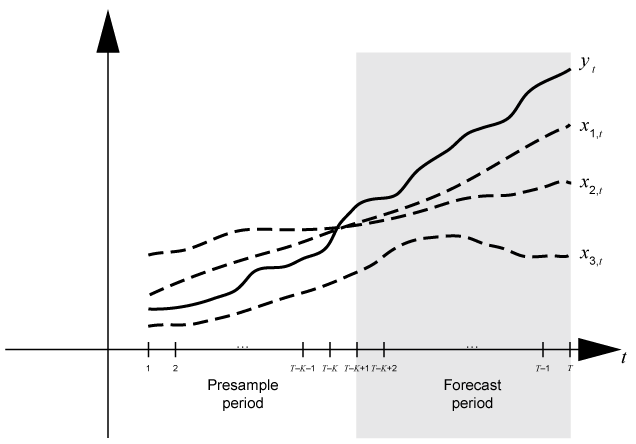

More About

Time base partitions for forecasting are two

disjoint, contiguous intervals of the time base; each interval contains time series data for

forecasting a dynamic model. The forecast period (forecast horizon)

is a numperiods length partition at the end of the time base during

which forecast generates forecasts Y from the

dynamic model Mdl. The presample period is the

entire partition occurring before the forecast period. forecast can

require observed responses Y0, regression data X0,

unconditional disturbances U0, or innovations E0

in the presample period to initialize the dynamic model for forecasting. The model structure

determines the types and amounts of required presample observations.

A common practice is to fit a dynamic model to a portion of the data set, then validate

the predictability of the model by comparing its forecasts to observed responses. During

forecasting, the presample period contains the data to which the model is fit, and the

forecast period contains the holdout sample for validation. Suppose that

yt is an observed response series;

x1,t,

x2,t, and

x3,t are observed exogenous

series; and time t = 1,…,T. Consider forecasting

responses from a dynamic model of yt containing a

regression component numperiods = K periods. Suppose

that the dynamic model is fit to the data in the interval [1,T –

K] (for more details, see estimate). This figure shows the time base partitions for forecasting.

For example, to generate forecasts Y from a regression model with

AR(2) errors, forecast requires presample unconditional disturbances

U0 and future predictor data XF.

forecastinfers unconditional disturbances given enough readily available presample responses and predictor data. To initialize an AR(2) error model,Y0= andX0= .To model,

forecastrequires future exogenous dataXF= .

This figure shows the arrays of required observations for the general case, with corresponding input and output arguments.

Algorithms

The

forecastfunction sets the number of sample pathsnumpathsto the maximum number of columns among the specified presample data sets:For input numeric arrays of presample data,

numpathsis the maximum width amongY0,E0, andU0.For an input table or timetable of presample data,

numpathsis the maximum width among the variables representing the presample responsesPresampleResponseVariable, error model innovationsPresampleInnovationVariable, and unconditional disturbancesPresampleRegressionDisturbanceVariable.

All specified presample data sets must have either one column or

numpaths> 1 columns. Otherwise,forecastissues an error. For example, if you supplyY0andE0, andY0has five columns representing five paths, thenE0can have one column or five columns. IfE0has one column,forecastappliesE0to each path.forecastcomputes the forecasted response MSEs by treating the predictor data matrices as nonstochastic and statistically independent of the model innovations. Therefore, the forecast MSEs reflect the variances associated with the unconditional disturbances of the ARIMA error model alone.forecastuses presample response and predictor data to infer presample unconditional disturbances. Therefore, if you specify presample unconditional disturbances,forecastignores any specified presample response and predictor data.

References

[1] Box, George E. P., Gwilym M. Jenkins, and Gregory C. Reinsel. Time Series Analysis: Forecasting and Control. 3rd ed. Englewood Cliffs, NJ: Prentice Hall, 1994.

[2] Davidson, R., and J. G. MacKinnon. Econometric Theory and Methods. Oxford, UK: Oxford University Press, 2004.

[3] Enders, Walter. Applied Econometric Time Series. Hoboken, NJ: John Wiley & Sons, Inc., 1995.

[4] Hamilton, James D. Time Series Analysis. Princeton, NJ: Princeton University Press, 1994.

[5] Pankratz, A. Forecasting with Dynamic Regression Models. John Wiley & Sons, Inc., 1991.

[6] Tsay, R. S. Analysis of Financial Time Series. 2nd ed. Hoboken, NJ: John Wiley & Sons, Inc., 2005.

Version History

Introduced in R2013bIn addition to accepting input presample and in-sample data in numeric arrays,

forecast accepts input data in tables or regular timetables. Use

Presample to supply presample data and InSample

to provide in-sample (future) predictor data for the model regression component in the

forecast horizon.

When you supply data in a table or timetable, the following conditions apply:

forecastchooses the default presample response series on which to operate, but you can use the optionalPresampleResponseVariablename-value argument to select a different variable.forecastreturns results in a table or timetable.

Name-value arguments to support tabular workflows include:

Presamplespecifies the input table or timetable of presample response, predictor, error model disturbance, or regression innovation data.PresampleResponseVariablespecifies the name of the response series to select fromPresample.PresamplePredictorVariablesspecifies the names of predictor series to select fromPresample.PresampleRegressionDisturbanceVariablespecifies the name of the unconditional disturbance series to select fromPresample.PresampleInnovationVariablespecifies the name of the error model innovation series to select fromPresample.InSamplespecifies the table or regular timetable of future predictor data for a model regression component.PredictorVariablesspecifies the names of the predictor series to select fromInSample.

See Also

Objects

Functions

MATLAB Command

You clicked a link that corresponds to this MATLAB command:

Run the command by entering it in the MATLAB Command Window. Web browsers do not support MATLAB commands.

Select a Web Site

Choose a web site to get translated content where available and see local events and offers. Based on your location, we recommend that you select: .

You can also select a web site from the following list

How to Get Best Site Performance

Select the China site (in Chinese or English) for best site performance. Other MathWorks country sites are not optimized for visits from your location.

Americas

- América Latina (Español)

- Canada (English)

- United States (English)

Europe

- Belgium (English)

- Denmark (English)

- Deutschland (Deutsch)

- España (Español)

- Finland (English)

- France (Français)

- Ireland (English)

- Italia (Italiano)

- Luxembourg (English)

- Netherlands (English)

- Norway (English)

- Österreich (Deutsch)

- Portugal (English)

- Sweden (English)

- Switzerland

- United Kingdom (English)