hfilter

Syntax

Description

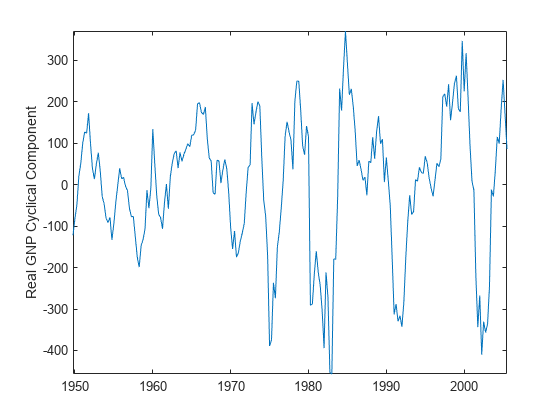

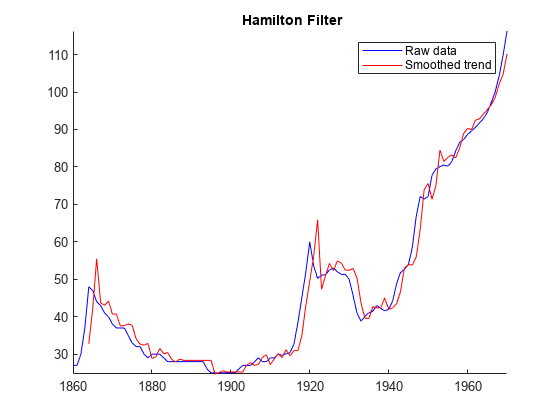

The hfilter function applies the Hamilton filter to separate

one or more time series into additive trend and cyclical components.

hfilter optionally plots the series and trend component, with

cycles removed.

In addition to the Hamilton filter, Econometrics Toolbox™ supports the Baxter-King (bkfilter),

Christiano-Fitzgerald (cffilter), and

Hodrick-Prescott (hpfilter) filters.

[

returns the additive trend and cyclical components from applying the Hamilton filter

[2] to each variable (column) of an input matrix of

time series data.Trend,Cyclical] = hfilter(Y)

[

returns tables or timetables containing variables for the trend and cyclical components

from applying the Hamilton filter to each variable in an input table or timetable. To

select different variables to filter, use the TTbl,CTbl] = hfilter(Tbl)DataVariables

name-value argument.

[___] = hfilter(___,

specifies options using one or more name-value arguments in

addition to any of the input argument combinations in previous syntaxes.

Name=Value)hfilter returns the output argument combination for the

corresponding input arguments. For example, hfilter(Tbl,LeadLength=4,DataVariables=1:5)

applies the Hamilton filter to the first five variables in the input table

Tbl, and, for each selected variable, specifies the lead

yt + 4 as the response

variable in the filter weight regression.

hfilter(___) plots time series variables in the input

data and their respective smoothed trend components (cycles removed), computed by the

Hamilton filter, on the same axes.

hfilter(

plots on the axes specified by ax,___)ax instead of

the current axes (gca). ax can precede any of the input

argument combinations in the previous syntaxes.

Examples

Input Arguments

Name-Value Arguments

Output Arguments

More About

Tips

Regarding a setting for the

LeadLengthname-value argument, Hamilton [2] states "If we are interested in business cycles, a 2-year horizon should be the standard benchmark." Regarding a setting for theLagLengthname-value argument, the article states "One might be tempted to use a richer model to forecast yt+h, such as using more than 4 lags, or even a nonlinear relation. However, such refinements are completely unnecessary for the goal of extracting a stationary (cyclical) component, and have the significant drawback that the more parameters we try to estimate by regression, the more the small-sample results are likely to differ from the asymptotic predictions."

References

Version History

Introduced in R2023a